san francisco sales tax rate breakdown

2020 rates included for use while preparing your income tax. The 2018 United States Supreme Court decision in South Dakota v.

Unaffordable California It Doesn T Have To Be This Way

The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025.

. 0875 lower than the maximum sales tax in CA. The transient occupancy tax is also known as the hotel tax. The current total local sales tax rate in san francisco ca is 8625.

This rate includes any state county city and local sales taxes. Has impacted many state nexus laws and sales tax collection. Limited to 15 per year on the minimum base tax 30 per year on.

The San Francisco County sales tax rate is. The San Francisco County sales tax rate is. Please visit our State of Emergency Tax Relief page for additional.

The average cumulative sales tax rate in South San Francisco California is 988. The timezone for San. 1 bed 1 bath 661 Peralta Ave 4 San Francisco CA 94110 655000 MLS.

Our GIS-based sales tax website allows the user to view sales tax receipts from calendar. As far as sales tax goes the zip code with the highest sales tax is 94128 and the zip code with the lowest sales tax is 94102. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375.

A full list of locations can be found below. Businesses impacted by recent California fires may qualify for extensions tax relief and more. San Francisco MLS For Sale.

21 rows Diesel Fuel except Dyed Diesel Rates by Period. Since 1974 the San Francisco sales tax rate has increased eight times from 650 percent to the current rate of. This rate includes any state county city and local sales taxes.

This scorecard presents timely. The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy. The minimum sales tax in California is 725.

South San Francisco is located within. San francisco sales tax rate breakdown. San Francisco imposes a 14 transient occupancy tax on the rental of accommodations for stays of less than 30 days.

The latest sales tax rate for San Francisco CA. This includes the rates on the state county city and special levels. Sales Tax Rate plus applicable district taxes Sales Tax Rate Qualified Agricultural Use of Diesel plus applicable.

The latest sales tax rate for San Francisco County CA. 2020 rates included for use while preparing your income tax. With local taxes the total sales tax rate is between 7250 and 10750.

Take advantage of amazing TIC lender rates as low as 35 while standar.

List These California Cities Will See A Sales Tax Hike On July 1 Kron4

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

In California Transfer Taxes Are Hefty What Sellers Need To Know

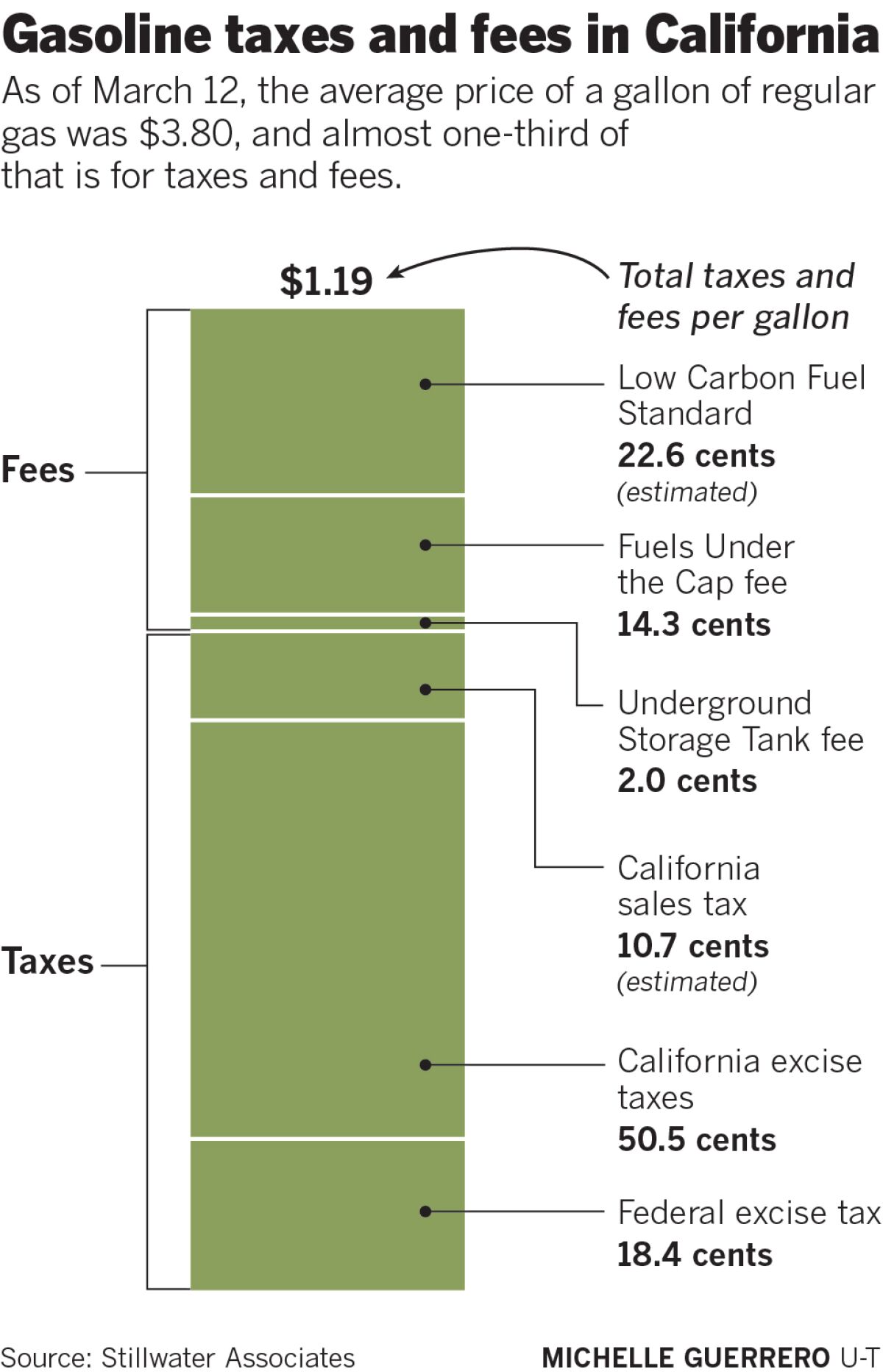

How Much Are You Paying In Taxes And Fees For Gasoline In California The San Diego Union Tribune

Sales Tax In Orange County Enjoy Oc

California Taxes A Guide To The California State Tax Rates

Sales Taxes In The United States Wikipedia

California Sales Tax Rate Rates Calculator Avalara

House Prices In San Francisco Bay Area Experience Steep Declines From April Peak Craziness Down Year Over Year Wolf Street

How To Use A California Car Sales Tax Calculator

State And Local Sales Tax Rates 2018 Tax Foundation

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Us Sales Tax On Orders Brightpearl Help Center

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Tax Guide Best City To Buy Legal Weed In California Leafly

Where Do Our Taxes Go Before Leaving California Consider The Facts Lifeguard Wealth Fee Only Financial Advisor In San Rafael Ca

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

New Sales And Use Tax Rates Take Effect In Some East Bay Cities This Week San Ramon Ca Patch

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium